What is Leasing and how does it work?

The term “leasing” originated in the USA and designates a particular means of granting the possession and use of an asset. To “lease” something means to let a person have the use of an object by renting out that object in question to that person. Leasing enables companies, private individuals and the state sector to invest in commodities and real-estate assets without having first to acquire ownership of them. An entrepreneur may plan, for example, to acquire a new piece of plant or machinery, or a vehicle. The leasing company pays the acquisition costs and, if asked to do so, provides further service components (such as repairs and maintenance). Against payment of a monthly fee, the leasing customer (lessee) enjoys unlimited use of the asset. The leased item usually remains the property of the leasing company (lessor). After the leasing contract has run its course, the leased item is returned to the lessor, who then sells it on.

Leasing is now an integral part of everyday economic life, and has become an increasingly popular financing tool in the medium-sized enterprise sector. The value of all the economic assets currently being leased in Germany stands at over 220 billion euro. More than half of all investments in equipment financed externally (i.e. not with equity capital, or with tax returns from depreciation) are realized through leasing, and leasing accounts for almost a quarter of aggregate investment in equipment. Any legally independent asset that can be utilized by a third party is inherently leasable. “Capable of being utilized by a third party” means that the leased item is not such that it can only be put to meaningful economic use by one single person or entity (i.e. by only one particular lessee).

From a purely legal point of view, a leasing agreement concluded in Germany will have some of the same basic characteristics as a normal rental contract as defined in the German Civil Code (BGB). But on account of certain of its defining features, a leasing agreement does not constitute a civil-law rental contract. Instead, a leasing agreement is a sui generis contract that up until now has not been satisfactorily regulated by any German law. However, certain standards have been defined by decree (the so-called Leasing Erlasse) concerning the fiscal treatment of leasing agreements.

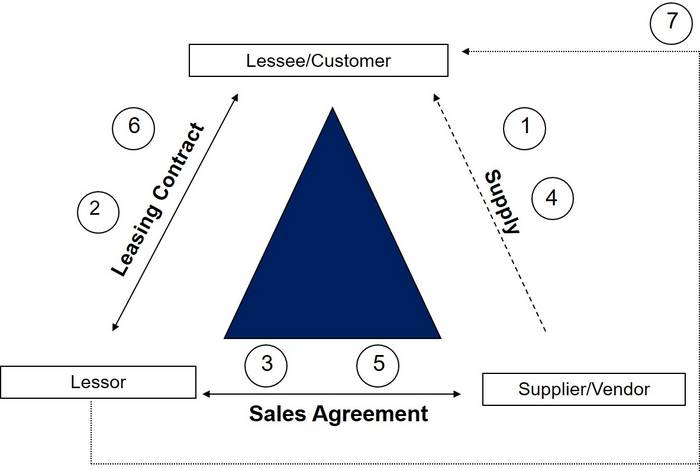

The “Leasing Triangle” and the Leasing Process

One of the most typical features of all leasing “products” is that three parties are involved in the investment process: the customer = the lessee, the supplier = the manufacturer / the dealer, and the leasing company = the lessor.

1. Selection of the item to be leased: The lessee approaches the dealer or manufacturer and seeks out the item to be leased.

2. The leasing agreement: A leasing agreement is concluded between the lessor and the lessee.

3. The purchase agreement: The lessor either concludes a purchase agreement with the dealer/manufacturer (the usual case), or he enters into a purchase agreement already concluded between the lessee and the dealer/manufacturer (the so-called entry model).

4. Supply of the leased item: As a rule, the leased item is supplied by the dealer/manufacturer to the lessee direct. When the leased item is handed over, the lessee becomes the lessor’s agent.

5. Payment for the leased item: The lessor pays the dealer/manufacturer the purchase price for the leased item supplied. Upon making this payment, the lessor acquires ownership of the leased item.

6. Payment instalments: The lessee pays the lessor instalments (usually on a monthly basis) for the use of the leased item.

7. Liability for defects / warranty: If defects in the leased item are detected within the warranty period and/or within the guarantee period, the lessee enjoys the same rights vis à vis the dealer/manufacturer as a purchaser, for the lessor has passed on to the lessee the right to make claims against the dealer/manufacturer that he obtained under German Sales Law when he entered into the purchase agreement (see 3. above).

Advantages of Leasing

Leasing customers value the option of returning leased items – especially when the item in question is a motor vehicle

The BDL has been conducting surveys into how commercial companies use leasing for over 25 years, and one of the standard questions it puts to company decision-makers is what attracts them to leasing. “Returning leased items at the end of the leasing term” seems to be the deciding argument for today’s leasing customers. And this response also sums up perfectly the underlying principle of leasing.

The possibility of Returning Leased Items

This option has for the first time made it to 1st place in the list of the 5 top reasons for using leasing as a financing tool. In 2nd place comes the advantage of predictability: “Costs are evenly spread, and can be calculated exactly”. Financial aspects such as “Protecting Liquidity” (in 3rd place) and “Maintaining a credit line with a bank” (in 5th place) are the key reasons why small and medium-sized enterprises in particular favour leasing. “Keeping plant and business equipment fully up to date”, by contrast, has stayed exactly where it was in 2015 (in 4th place). It would appear that liquidity constraints are a less pressing consideration for larger companies, which tend to use leasing to finance custom-tailored investment solutions in order to maintain flexibility.

Leasing Creates Flexibility

Leasing guarantees a contractual arrangement that not only meets the needs of the lessee company but also reflects the progressive change in the value of the asset that has been invested in. As regards both the definition of agreement lifetimes and the definition of the end-of-lifetime modalities (i.e. what happens to the leased item after the agreement has run its course), leasing delivers maximum flexibility. Buying the item outright, or, alternatively, agreeing to renew the lease are both available as options. Or the lessee may even opt to take a share of the proceeds from the remarketing of the leased item after the termination of the leasing agreement.

Supplementary Services Can Free Up Business Capacities

The attractiveness of leasing can be greatly enhanced by the provision of additional maintenance and service packages. Repair work, the provision of insurance cover and even fully comprehensive service contracts (e.g. for leased car fleets or IT equipment) are all on offer in the equipment-leasing sector, while project-management, facility-management and planning services are commonplace in the real-estate sector. Leasing thus provides companies with the possibility of comprehensively outsourcing many of the tasks that necessarily accompany investment projects.

German Leasing Decrees

The four leasing decrees issued as administrative orders by the Federal Ministry of Finance (BMF) in Germany govern the attribution of economic ownership of leased assets and the year-end balance-sheet reporting of the leasing relationships between lessor and lessee. These decrees form the fiscal basis for all leasing business transacted in Germany. The leasing decrees are available in german only.